Introduction to Fraternity Finances

One of the biggest misconceptions is that financial matters are the responsibility of the Crysophylos. One of the most common reasons that a group fails is poor financial management — too many members not paying their bills, expenditures in excess of income, deterioration of physical facilities, cancellation of events, etc. Every man has a right to know how his money is being spent, and should insist that it is spent wisely.

The Crysophylos is the Chief Financial Officer of the chapter, but he is aided by the Recruitment Committee, House Committee, Social Committee, Activities Committee and the other officers on the executive board. Without the help of these individuals, it is impossible to ask the Crysophylos to budget, collect, and properly distribute funds.

Use the resources below to build a budget, establish financial stability, and properly report spending/ income, among other things. This all sounds very daunting, but once you create the fundamentals the chapter will begin running like a well-oiled machine. Everything can then be passed down to the next person in charge. The biggest thing to remember is that brotherhood begins when the bills are paid.

Fee Structure 2025-2026

Candidate Fee – $125 per man

All candidates must pay this non-refundable fee, which is due within 15 days of bid acceptance. Officers must register each candidate using the TKE Chapter Module. Each candidate will receive a validation email to complete their registration process and pay their fees via MyTKE.org. After 15 days, the chapter becomes responsible for the Candidate Fee even if the candidate drops out before initiation. Chapter officers should use the TKE Chapter Module to monitor which candidates have paid their fee to the Offices of the Grand Chapter.

Initiation Fee – $200 per man ($325 total with Candidate Fee) or One-time Initiation Fee Option – $800 per man ($925 total with Candidate Fee)

Prior to initiation, each candidate must pay an Initiation Fee, which should be done using MyTKE.org. Initiates who pay the One-time Initiation Fee Option will not have to pay Annual Membership Fees for the rest of their collegiate careers. If the Initiation Fee is not received within 15 days of initiation, a penalty equal to 40% of the Initiation Fee ($90) will be added to your chapter statement.

Annual Membership Fees – $205 per man for the year (or $118 per man each semester)

The best option is to pay your AMF in full for the year, due by October 1. The chapter will save $35 per man by paying the full year incentive rate. If choosing the base rate/split option, the first installment of $118 per man is due October 1, and the second installment of $118 per man is due no later than March 1. All returning active members of TKE chapters are obligated to pay this fee.

Graduate students have the option to be active members of a TKE chapter. Any graduate student wishing to be an active member must pay Annual Membership Fees. Graduate students include all students who have received a bachelor’s degree but are still taking classes at a college or university.

Risk Management Fee – See Risk Fee Explained

The Risk Management Fee is assessed once a year based on the roster submitted by the chapter leadership. If the fee is paid in full by the early-bird deadline of October 1st, the chapter will receive a 10% credit on the statement which can be used toward future invoices. If the fee is not paid in full by the early bird deadline, the chapter must pay at least ½ (50%) of the total invoice by October 15th. Once half of the invoice is paid, the remaining amount owed will be due in full by March 15th.

For more information see our risk management guide.

Chapter Assessment Fee – $500 single payment; or 2 payments of $390 (Total of: $780) per Chapter

The chapter assessment fee is an annual fee each chapter pays to support the TKE Nation ensuring dependable access to chapter services and resources. It will be due in two equal installments of $390, one due October 31 & the second due March 31, or a single payment of $500. If selected, the incentive rate of $500 is due October 31.

Conclave Savings Plan – $250 per semester

Conclave installment payments are due no later than October 31 for the fall semester and March 31 for the spring semester. The CSP is a savings plan offset the cost of sending a delegate from each chapter to the 2026 Conclave. There are four payments towards this per biennium.

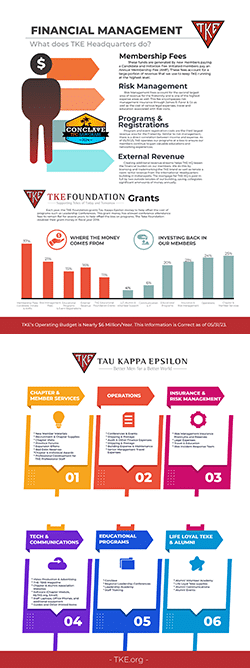

How does TKE manage our money?

TKE is dedicated to building better men for a better world. We do that by providing our members with the tools and resources to grow and learn so that they can ultimately become the best version of themselves. This infographic is a great source of information on how our organization utilizes its funds, along with the funds generated from external sources, to provide the TKE experience that you know and love.

Budget FAQs

One of the most important tools in the management of expenses is the Chapter budget. A budget is an intelligent estimate of income and an expense plan for the spending of that estimated income.

Why is a budget important?

A budget must be written. Without putting it on paper, it is just a dream. Failing to plan is planning to fail. You have to plan, project, and adjust your revenue and expenses in order to be successful.

2025-2026 Sample Budget

We have updated the sample budget to fit the fee structure for 2025-2026. We have split the annual budget in separate tabs by semester. This sample budget shows both the fixed and variable expenses your chapter may deal with throughout the year. The fixed expenses (TKE HQ fees) are set amounts from the fee structure. The variable expenses (local chapter expenses) are not set amounts and can be adjusted to fit your chapter operations. With the variable expenses, you may add rows and remove this lower section of the sample budget. Keep in mind this is a basic budget that does not include items such as housing. The purpose of this tool is to assist your chapter in the budgeting process.

Below are some notes to keep in mind for each budget when using this tool.

It is important to note that in its original form, the fall and spring sample budgets show the chapter paying the “one-time” option for Chapter Assessment, Annual Membership Fees, and Risk Management Fee.

Fall Semester Budget -To determine your fixed expenses for the fall semester, you will simply input the number of men returning in the fall as well as divide out how you would like the AMFs to be billed. From there, all of your fixed expenses for the fall should calculate accordingly and you will only need to adjust the variable expenses as needed.

Spring Semester Budget – To determine your fixed expenses for the spring semester, you will input the number of men returning in the spring. When entering the AMF billing numbers, these should mirror what you entered for the fall semester. The only difference will be if you have men returning to the chapter after time away from school or from studying abroad. These Fraters will be billed a half year AMF and put in the “Spring Semester Only” row. If your chapter is not paying all of the one-time options in the fall, please make sure to update the spring budget formulas/amounts for Chapter Assessment Fee, Full Year Annual Membership Fees, and the Risk Management Fee.

Who develops and approves the budget?

The budget is compiled by the Crysophylos with the input of officers and the chapter finance committee (if applicable).

Once ready, the Board of Advisors reviews, helps adjust, and approves the budget.

Then the budget goes to a chapter vote with acceptance of budget at 51%. The budget should not be changed without the knowledge of the Board of Advisors. It is important to note that nobody can individually change expense allocations. Doing so is called misappropriation.

When is a budget written, reviewed and evaluated?

Here is a sample timeline for effective budget management:

March 1 – Crysophylos puts together initial budget

March 15 – Budget reviewed by officers and committees

April 15 – Budget reviewed and approved by Board of Advisors

May 1 – Budget approved by chapter

First meeting of Fall – Re-Review budget with chapter

January 15 – Board of Advisors financial audit

The Crysophylos should track, review and balance monthly.

How can we improve our budget performance?

Contact your key volunteers or your Regional Director for specific questions on your budget and how to improve chapter relations.

Login to your Chapter Module, click on Dashboard on the left. You have valuable resources listed under Professional Staff Contacts and Volunteer Contacts.

Financial Stability

What is the most important factor in the success of a chapter? A strong brotherhood? Good leadership and management? A large number of men? A nice house? All of these factors are important and may even be critical for a chapter. However, one of the most overlooked factors is good financial management or financial stability.

Two mistaken impression often exist among members, and both statements are erroneous and dangerous to the health of a chapter:

- That financial matters are entirely the concern of the Crysophylos, and

- That financial management consists of keeping a good set of records.

Financial matters should be a concern of every man and especially each officer. One of the chief reasons for the failure of many groups is poor financial management — large number of members not paying their bills, expenditures in excess of income, deterioration of physical facilities, cancellation of events, etc. Every member has a stake and, therefore, has a right to know how his money is being spent. He should insist that it is spent wisely.

Although an accurate record of all income and expenditures following some acceptable format is important, good financial management is much more than this. The essence of financial management is:

- planning, and

- control — developing a budget and establishing procedures to insure that expenses do not exceed budgeted amounts.

As a member of officer, here are a few things that you can do to increase the probability that your chapter will be financially stable:

- Insist that a budget be established at the beginning of each school year and reviewed periodically. A budget should be simple to understand: Income = number of men x dues. Expenses categorized by area: social, rush, etc. Expenses do not exceed income. A good target is that the total of all budgeted expenses should not exceed 90% of the projected income.

- Require a written financial report from the Crysophylos periodically – at least once every three months. This report shows what income has been received and where the money has been spent, with the expenditures in each area being compared to the budgeted amounts.

- Make sure your chapter has some sound financial policies in these areas:

- Payment of dues: A definite schedule for payment with stated grace period. All persons not paying by the end of the grace period lose all membership privileges until the dues are paid. You do your chapter and the individual involved a disservice by allowing him to enjoy the benefits of the Fraternity without paying his fair share of the costs; this is poor training for the future-in both family and organization financial affairs.

- Budgeted Expenditures: No committee or individual can spend more than the budgeted amount for his area unless someone else agrees to a reduction in the amount budgeted to them. It is the responsibility of the Crysophylos, through good record keeping, to make sure the budget is not exceeded.

- Payment of dues: A definite schedule for payment with stated grace period. All persons not paying by the end of the grace period lose all membership privileges until the dues are paid. You do your chapter and the individual involved a disservice by allowing him to enjoy the benefits of the Fraternity without paying his fair share of the costs; this is poor training for the future-in both family and organization financial affairs.

- Establish a Finance Committee composed of several people to (a) help draw up the budget, (b) to formulate and enforce financial policies, and (c) offer advice on financial problems.

- Involve the Board of Advisors, who should be the watchdog in all financial matters by (a) approving the budget, (b) getting copies of financial reports, (c) approving expenditures for capital improvements (new furniture or equipment, repairs or remodeling of house, etc.), and (d) being consulted on major financial problems.

No organization, whether it be a fraternity, a university, or a business, can survive without good financial management.

Accounts Receivable

Many chapters have problems with the collection of dues. Dues that are owed but not yet paid are known as Accounts Receivable. Accounts Receivable is like a contagious disease to your chapter. If left untreated, your chapter will soon be crippled or dead. It can be cured, but it is best to avoid the problem in the first place.

Here are two possible incentive plans that can help keep your Accounts Receivable to a minimum. It is strongly recommended that your chapter adopt one of these plans.

The Discount-Incentive Plan

- At the beginning of each term or semester, each member is given a bill for the total amount of dues for the term.

- A deadline is set for the payment of dues in full (usually the third week of the term).

- All members who pay all of their dues by the deadline are given a discount of a certain amount. (For example, if dues are $600 per semester, all Fraters who pay before the deadline could be given a discount of $60).

- Any member who cannot pay all of his dues by the deadline must make at least a one-third payment by the deadline. The remaining two-thirds are divided into two equal installment payments, due at the first of each of the next two months.

Example: Jim is a member of a chapter whose dues are $450 per semester. He must pay the Crysophylos at least $150 before the deadline. The remaining two-thirds ($300) is due in two monthly installments of $150 at the beginning of each of the next two months.

The Penalty-Incentive Plan

- At the beginning of each term or semester, each member is given a bill for the total amount of dues for the term.

- A deadline is set for payment of the dues in full for the term (again, usually the third week of the term).

- Any member who does not pay all of his dues by the deadline is fined a specific amount (usually 5 % to 10%).

- For any member who does not pay in full, the total amount (dues plus fine) will be divided into three equal payments. The first payment will be due at the deadline that was set up as above. The remaining two payments will be due at the first of each of the next two months.

Many TKE chapters have proven time and time again that these plans are the two best methods for keeping Accounts Receivable to a minimum. Both plans offer some type of encouragement for Fraters to pay their dues on time. Billing dues on a monthly rate quadruples the effort needed to collect dues. Paying dues in full at the beginning of the term is simpler, easier to enforce, and puts chapter income in the bank as soon as possible.

Even with these plans in force, some members may still fall behind in paying dues. This is usually due to failure of the officers to enforce the penalties for non-payment of dues. Your chapter should have specific rules as to the penalties for not paying dues. These penalties should include all of the following:

- A member who is behind in dues cannot play in intramural sports.

- A member who is behind in dues cannot attend any social functions.

- A member who is behind in dues cannot vote at meetings.

- A member who is behind in dues cannot run for chapter office.

- A member who is behind in dues cannot be a Big Brother.

These penalties should be a part of your chapter bylaws and should be enforced regularly and equally for every member, including officers.

Accounts Receivable (AR) Ledger

The Accounts Receivable Ledger is an accounting tool that lets you record all debt and payments of each individual member. Regular maintenance of these ledgers gives the chapter an up-to-date record of all money owed the chapter.

An individual page is used for each member. Start a page for a member as soon as he becomes a candidate. Each time a member is charged for something, such as dues, Red Carnation Ball, etc., an entry is made into his ledger. Every time he pays the chapter money, an entry is also made, this time in the payment column.

This is the individual ledger for David W Dow. At the top of the page, the Crysophylos has entered the information needed to contact Frater Dow. The first item recorded on Frater Dow’s account is a charge for dues for the fall semester ($450). A similar entry will be made in every Frater’s account for the term.

On August 25, the Crysophylos received a check from Frater Dow for $450. This was recorded as a payment and subtracted from the balance due, resulting in a new balance due of $0. The Receipt #167 in the description column refers to the receipt number that was given to Frater Dow by the Crysophylos.

The following semester, the Crysophylos has recorded an item for Frater Dow’s spring dues ($450). A similar entry will be made in every Frater’s account for the term. Frater Dow will be unable to make one payment for dues this semester, and is charged a $45 penalty on January 31 because the chapter uses the Penalty-Incentive Plan. His new balance due is $450 + $45 = $495.

On February 1, March 1, and April 1, Frater Dow makes his three monthly payments. Each is recorded in the ledger. Notice that by keeping an individual member ledger, the Crysophylos can tell at any time, how much each member owes by looking at the most recent entry in the balance due column.

Tips for Handling Money

- Keep all chapter money in a safe place at all times. There are several lockable fireproof cash boxes readily available on the market today. Some of these can be bolted down for extra security.

- Deposit all cash and checks into the chapter bank account as soon as possible. This will prevent possible loss from theft and will make reconciling the bank statement much easier. Do not allow cash to accumulate.

- Every time money is received by the Crysophylos, a receipt is written. This must be done in order for the receipts to balance with the Accounts Receivable Ledger.

Previously, the account of Frater David Dow was discussed. These sample receipts represent the payments that Frater Dow made to the chapter. Each receipt is numbered consecutively as they are written by the Crysophylos. Frater Dow’s receipts are not in consecutive order since many other fraters made payments during this time. Note that each receipt is written clearly and that the amount of payment is written twice, just as on a check.

Collection Techniques

- Meet with all members at the beginning of each semester to make sure they understand the financial expectations and establish a payment plan if necessary.

- Request that he sign a promissory note.

- Require the member to appear before the Membership Quality Board (MBQ) to explain and resolve his delinquency.

- Begin trial proceedings as outlined in the Black Book to hold the member accountable by suspending some or all of his membership privileges or remove his membership in the Fraternity.

Here are some ideas which represent a composite of many collection procedures used by other TKE chapters.

Outsource Dues Collections

Many chapters are having success using a third party to bill and collect dues from their members. The vendor usually collects directly from a checking account or credit card, and then makes the funds available to the Crysophylos over the internet. GreekBill is our recommended provider.

Regular Monthly Billings

This method sounds so obvious that many chapters overlook it completely. By sending every member a written statement of his bill each month, payment is more likely. A regular billing procedure is just as good a business practice. If you haven’t tried it, take time to do it. Establish a series of friendly collection letters to follow-up delinquent accounts. In each case, leave the door open for explanations of any misunderstandings and set a definite date for action.

Discounts

Grant a discount to men who pay in advance. You might budget for a 10% discount to any Frater who pays his entire dues early. This will also permit adequate cash at the onset of a semester when it may be needed most. When budgeting, the Crysophylos will have to consider the number of members who will take advantage of this feature because it will mean a reduction in income for the chapter.

Fines or Penalties

Probably one of the most widely used methods of aiding in dues collecting is the penalty or fine. Very simply stated, if you don’t pay your dues, a fine or penalty is added to what you owe. Since this system adds an additional burden to those who are already not able to pay, the Crysophylos should discuss the indebtedness with each man involved so that a schedule of payments may be set up.

Letters to Parents

Another effective method may be a letter to the parents. This method should be used only after you have tried to collect from the Frater and have not been successful. It is also advisable to tell a man that you will have to write his parents. Some chapters invoice the parents instead of the member.

Notes

Once an obligation has been established, and especially if the Frater is leaving the chapter, have him sign a note. This promise to pay must have a date, location, amount, reason for the indebtedness, and be signed. An account is much more collectible in the form of a note rather than an open account because the member has acknowledged the debt. In most states, a note for room and board is collectible even if a member is not of legal age because they are necessities.

College or University Assistance

Check with your college or university to see if they will hold diplomas, transcripts or grades until all obligations are paid. If they will, don’t be embarrassed to give them your delinquent accounts and ask for help. If your college or university will not aid in this way, possibly your IFC could undertake this as a project.

Pro-Rating

Pro-rating is a technique which is designed to aid a Crysophylos because it puts additional pressure on the debtor. At the end of a collection period, the amount owed is divided up among all the Fraters who have paid their bills. They must pay this additional assessment, but will receive credit for their share when all of the delinquent Fraters pay. The bookkeeping involved in this system is quite complex. The principle, however, is to have all members put pressure on the few who fail to pay past due accounts.

Reporting

This is another obvious technique that is often overlooked. A Crysophylos report to the chapter each month should contain the names of the delinquent members along with the amount they owe.

Financial Reports

The financial reports necessary from the Crysophylos are simple versions of basic accounting reports. If you have an accounting background and understand cash- and accrual-basis, or are comfortable using software like QuickBooks, you can implement that in your chapter too. But in the meantime, leave the Balance Sheet and Statement of Cash Flows to the professionals.

The Income Statement, sometimes called Profit and Loss (P&L), shows your Revenue and Expenses for a period. That period is usually Year-To-Date, which means the period starting on the first day of the fiscal year and ending on the date of the report. Most chapters begin their fiscal year on June 1 and end on May 31.

Often, the Income Statement compares actual-to-budget for the same period or actual-to-budget for the fiscal year. The latter is preferred for TKE chapters. Here’s how to complete an Income Statement:

- Date the Income Statement with the date of the accounting period. Since the Income Statement is reported Year-To-Date, use the period from the beginning of the Fiscal Year to the end of the current month.

- You should have a list of everyone who has paid their chapter dues. Total the amounts paid, and record it as Chapter Dues Revenue. Only record revenue for the actual cash that you have received. So, for example, if chapter dues are $450, and Frater Joe pays $150, you would increase Chapter Dues Revenue by $150.

- New Member Fees are recorded as revenue if collected by the chapter. When the chapter pays the Candidate and/or Initiation Fee, record that amount as an expense. It is recommended that the candidates pay directly using the TKE Chapter Module, rather than the chapter collecting the fees.

- Report all other revenue on the appropriate lines. Remember that this report is Year-To-Date, so each revenue line should represent the total amount your chapter has received all year.

- Add up all the revenue and enter the total.

- Each time you make a payment, it needs to be recorded as an expense in the correct category. So, for example, if the chapter paid $400 to dry-clean the officer robes, the transaction adds an expense of $400 to Officer Funds Expense. If the starting balance for this expense account was $200, the new total would be $200 + $400 = $600.

- Add up all the expenses and enter the total.

- Total Revenue minus Total Expense is your Net Income – the gain or loss on operations.

The second financial report that you should complete is the Chapter Assets and Liabilities. On this report, you list assets, which are things that have value that a chapter owns, and liabilities, which are the debts that your chapter owes. Here’s how to complete the Chapter Assets and Liabilities, which is really just a modified version of a Balance Sheet:

- Use the balance of your checkbook and enter it as Cash in Bank Account. When the bank statement comes each month, you should reconcile the bank statement to your checkbook.

- Cash on Hand is any money that you haven’t deposited.

- Accounts Receivable is the sum of all money owed to your chapter. Get this total by summing the balances from the Individual Ledgers of each Frater.

- The total due to the Offices of the Grand Chapter should match the balance on your chapter statement.

- The total due to James R. Favor & Company should match the outstanding balance of your Risk Management Fees, even if these fees are not yet due.

- The total due to ACP Resources should match the outstanding balance of your Annual Membership Fees, even if these fees are not yet due.

Fundraising

Tau Kappa Epsilon is a not-for-profit corporation in the state of Indiana, and is recognized by the Internal Revenue Service as a not-for-profit corporation. This means that the federal government will not tax any profit generated by TKE. It does not mean, however, that donations to TKE are tax deductible.

Section 6113 of the Internal Revenue Code imposes a requirement on not-for-profit tax-exempt organizations that a “conspicuous and easily recognizable” statement appear on all fund-raising solicitations, including dues billings and housing invoices. The statement must specify that all contributions and payments made to the organization are non-deductible as charitable contributions for federal income tax purposes. Failure to comply can result in a $1,000 per day penalty by the Internal Revenue Service.

This disclosure requirement is applicable to all organizations exempt from taxation under 501(c) of the Internal Revenue Code, which includes almost all TKE chapter corporations, unless organized as a 501(c)(3) corporation (like the TKE Foundation).

Our legal counsel advises that the following language should appear on all fundraising solicitations, dues billings, and invoices:

Contributions and payments to (insert name of chapter, Board of Advisors, house corporation, etc.) are not deductible as charitable contributions for federal income tax purposes. However, they may be deductible under other provisions of the Internal Revenue Code.

Tax Filing & FAQ

Tau Kappa Epsilon Fraternity has partnered with www.File990.org to assist and support chapters through the tax filing process. You can learn more information about the partnership by reading below. The following frequently asked questions will help you as an officer and/or advisor better understand the requirements as it relates to tax filing for groups of Tau Kappa Epsilon.

Throughout the FAQ, the word “group” will refer to all subsidiaries of Tau Kappa Epsilon Fraternity including emerging chapters, chapters and chartered alumni associations. When an emerging chapter transitions to a chartered chapter, their EIN will not change. The following information was adopted from Sigma Phi Epsilon.

If your group needs to acquire an EIN (Tax ID Number), please click here.

Does our chapter have to file a tax return with the IRS?

Every group of Tau Kappa Epsilon must file an annual return with the Internal Revenue Service (IRS). You will need to a short list of information to correctly file your annual return. A list of this information can be found here. The IRS enforces an automatic “three strikes and you’re out” policy with respect to annual filing. Failing to file a return three times results in automatic forfeiture of your group’s non-profit status. Once a group has lost their tax exemption, they must reapply – a sometimes costly and cumbersome process.

When’s the filing deadline with the IRS?

Tax returns are due on the 15th day of the 5th month after the group’s tax year-end. If a group’s tax year ends May 31st, the tax form would be due October 15th (the 15th of the fifth month after May 31st). If you aren’t sure of your year end, you can refer to the previous year’s filing paperwork. Additionally, you may visit GuideStar, a search engine providing the most up-to-date nonprofit data available, and search by your groups EIN. It is strongly encouraged that you select the same fiscal year dates as the International Fraternity, June 1 to May 31. Additionally, certain chapter officers will receive an email from our partners at File990.org when you are eligible to file. Click “get started” from that message, an if your chapter is able to file a 990N or 990EZ, you can do so online for a reduced price.

What happens if my Form 990 is filed late?

If an organization whose gross receipts are less than $1,000,000 for its tax year files its Form 990 after the due date (including any extensions), and the organization doesn’t provide reasonable cause for filing late, the Internal Revenue Service will impose a penalty of $20 per day for each day the return is late. The maximum penalty is $10,000 or 5 percent of the organization’s gross receipts, whichever is less. The penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000.

What tax return does a chapter need to file?

Every group files a version of the IRS Form 990 (Return of Organization Exempt From Income Tax). The specific version is determined based on the total gross receipts and assets of a chapter. Gross receipts are all income that a group receives during the year. The chart below identifies the version of the Form 990 your group must file.

| Gross Receipts and Assets | Form 990 Version |

| $50,000 or less | Form 990N An e-post card notification to IRS www.file990.org |

| Greater than $50,000 but less than $200,000 and assets < $500,000 | Form 990EZ www.file990.org |

| Gross receipts > $200,000 and/or Assets > $500,000 | Form 990 Search 990 on www.irs.gov to find the form and instructions |

Note: Be sure to include 4275 on the Form 990 as the group exemption code when filing.

Additionally, the chapter must file a Form 990T if “unrelated trade or business income” is greater than $1,000. This can include earnings from or payments received from non-members. This form is available through the IRS website found here.

Aren’t all TKE groups tax exempt?

Most of a group’s revenue would be tax exempt (dues and member fees). However, groups are liable for federal income tax on Unrelated Business income (UBI). Income from investments such as revenue from vending machines and renting rooms to non-members are examples of UBI.

Must the undergraduate chapter and the Alumni Association file separately?

Yes. The chapter is an “unincorporated association” that derives its non-profit status from a group exemption granted the national Fraternity, a 501(c)7 corporation. The Fraternity’s Headquarters is required to update its roster of chapters, and alumni associations annually with the IRS. TKE’s group exemption code is 4275 and should be included on all subordinate group returns. The Alumni Association is a separate corporation and must apply for its own non-profit status.

Are funds from fundraisers taxable income?

No. It must be included in your revenue total for the year, but is not considered UBI and will not be taxed.

Are donations to chapters and alumni associations tax deductible for the donor?

No. “Tax deductible” refers to a donor being able to deduct the amount of the donation from his/her income, thus reducing his/her taxes. Donations are only tax deductible when given to a charitable or educational 501(c)(3) corporation. A chapter, emerging chapter and/or alumni association does not qualify for this status. The TKE Foundation (TKEF) exists as 501(c)3 corporation for this express purpose—to receive and manage contributions for educational scholarships and programs.

The chapter has no employees, so why would it have an EIN?

The IRS uses EINs to track organizations just as it uses social security numbers to track individuals. The IRS requires all banks to relate either a personal social security number or EIN to any account opened. All chapters, emerging chapters and alumni associations are strongly encouraged to use their groups EIN to open an organizational bank account.

Will we owe income tax?

It depends. Anything over $1,000 in Unrelated Business Income (UBI) is taxable. If the group has over $1,000 in UBI then they must ALSO file a 990T.

How much will the income tax be?

The tax rate for organizations with less than $50,000 in unrelated business income (UBI) is 15%. It is highly unlikely that any group would have more than $50,000 UBI.

Is there any way to avoid owing income tax?

Chapters can avoid the tax on investment income only by following IRS procedures called “set-aside.” This IRS provision (originally written in a case for Sigma Phi Epsilon Fraternity in 1969 which still stands as IRS ruling for all fraternal organizations) allows organizations to “set aside” net investment income for charitable, religious, scientific, or literary or educational purposes. More information about “set-asides” can be found here.

What do I do if my group has lost its tax status?

If your group has lost its tax status, you will need to file IRS 1024 to be reinstated as a 501(c)7. You can find form 1024 on the IRS website. There is a onetime fee of $850.00 due to the IRS in order to process your paperwork. More information about the revocation and reinstatement can be found here.

Where can I go with additional questions?

Tau Kappa Epsilon Fraternity has partnered with File990.org for IRS 990 & 1024 support. Through this support, File990.org will provide the following services to TKE groups:

- Form 990 (Annual Filing)

- Reminders to all TKE groups when they need to file their 990 tax form.

- Phone and email support to any TKE group with their annual 990 tax filing.

- If you are interested in filing IRS Form 990 using the file990.org system, the cost will be at a discount through them. For all 990 questions, please contact Tanner Gill, Director of File990, at info@file990.org.

- Form 1024 (Reinstatement Filing)

- Support and assistant through the reinstatement filing process.

- Through this support, File990.org will provide a certified public accountant (CPA) to assist you with your reinstatement filing using Form 1024. If you are interested in using this service, please contact Tanner Gill, Director of File990, at info@file990.org.

For more information about File990.org, you may visit their website – www.file990.org, or give them a call at 859.309.3640.

Our Partnership with GreekBill

GreekBill was founded on the vision of providing value added financial management services to the Greek Community. They have led the industry in collection rate, customer service, satisfaction and the ability to adapt and customize solutions to meet each client’s unique needs.

They are constantly evaluating feedback that they receive from chapters and international organizations. Feedback from international officers, advisors, chapter officers and members is key in maintaining a product that is cutting edge and ahead of the rest. Throughout the years GreekBill has added additional services and tools in order to improve our clients GreekBill experience.

Their clients’ success in the financial arena has proven that GreekBill’s tools and management are a vital and essential piece to all Greek organizations that plan on growing and moving forward as a top organization. To ensure this success they will continue providing innovative technology, in-depth reporting and superb customer service so that they not only service the market but define it.

What they offer

- Special Discounted Rates for TKE Chapters (More information located in the TKE Chapter Module)

- Monthly Paper and/or Electronic Billing

- Real-Time Member Data and Financial Reporting

- 24-Hour Access to Accounts

- Online Payment Options (Credit Card, Debit Card, and E-check)

- GreekBill Chapter Representative

- Extensive Collection Process – Itemized Statements, Phone Contact, Collection Letters, and Credit Marking (optional)

- Online Donation and Registration Management

- Email Blasts and Announcement Tools

- Budget Builder/Tracker

- 990 State/Federal Tax Filing

Testimonials

“GreekBill has increased our chapter collections rate to almost 100%. Its online services are very easy to use and are available 24/7 which makes it very convenient for our chapter. Our chapter representative is friendly and always available which makes my job as the treasurer a lot easier. GreekBill has definitely bettered our financial structure and it is worth the investment!”

Nikhil Gupta

Crysophylos

Pi-Xi Chapter (University of California – San Diego)

“Efficient, polite, easy to reach, very helpful”

Ross A Swanson

University of Illinois

“GreekBill representatives were very helpful in helping us setup and learn the new system”

Austin Andrews

University of Main-Orono

“I was very pleased with my experience, very nice and informative”

Jack McCann

Stephen F. Austin State Universtiy

“I use GreekBill to help keep the financial side of my organization organized. GreekBill is very userful, and easy to use. They also work with your financial issues by giving the amount in payments and talking to you about the situation. Overall GreekBill is a nice financial tool to use. Thank You!”

Taylor Savory

Southern Polytechnic State University

“Greekbill is an easy-to-use, fair, and approchable option for the undergraduate fraternity student. They are quick to contact you about your payments and are very receptive to customers’ needs. Awesome site guys, thanks for being so approchable.”

Matthew Mazzaferro

Rider University

“GreekBill is convenient and safe to use! I have thoroughly enjoyed using your services. Thanks for everything!”

Eric Burgett

Millikin University

“GreekBill works, plain and simple.”

Nikhil Sen-gupta

University of Illinois at Urbana-Champaign

“Using GreekBill was a great way to pay my fraternity dues without writing a obsolete check!”

Martin Smith

St. Cloud State University

“I’m a chapter president and it makes it easily a 100 times easier to collect dues. GreekBill is a great service that streamlines chapter finances and makes transparency and running a fraternity so much easier.”

Kevin Kesslak

Saint Francis University

Contact

Check out the GreekBill Services FAQ page to get more detailed answers to common questions.

You can also visit Request a Demo/Get More Info page to ask a question about our services or request an information packet.